Saylor Set to Achieve 11th Consecutive Strike: A Game-Changer Ahead!

Michael Saylor’s bitcoin Accumulation Strategy: A Deep Dive into His 11-Week Streak

Saylor’s Unyielding bitcoin Acquisition

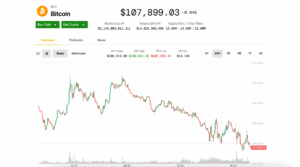

Michael Saylor has recently announced that his company has completed its 11th consecutive week of purchasing bitcoin, showcasing a steadfast commitment to accumulating the cryptocurrency. With a staggering reserve of 592,345 BTC, Saylor’s firm has established itself as a formidable player in the bitcoin landscape. The question remains: how far will this strategy extend?

Key Highlights

- Michael Saylor’s company has confirmed its 11th week of bitcoin purchases since April 14.

- The total bitcoin holdings now exceed 592,345 BTC, valued at over $63.6 billion.

- The firm has achieved a 52% return on its bitcoin investments, translating to approximately $21.8 billion in unrealized gains.

- This company possesses more bitcoin than the combined total of the 20 largest competing firms.

Strengthening Market Position

On June 23, Saylor’s company made headlines again by acquiring an additional 245 Bitcoins for $26 million. This latest purchase has solidified its status as the largest institutional holder of bitcoin globally. According to BitcoinTreasuries, the firm now holds more than double the bitcoin of the twenty largest publicly traded companies combined.

This aggressive accumulation strategy is not new; it has been in place since 2020, driven by Saylor’s belief that bitcoin is the “digital gold of the 21st century.” On social media, where he boasts over 4.4 million followers, he often emphasizes the importance of investing in bitcoin.

“In 21 years, you will regret not having bought more.”

Saylor’s approach diverges from traditional investment strategies, opting instead to concentrate the majority of the company’s treasury in bitcoin. While this is a high-risk strategy, it has proven successful thus far.

The Impact of Saylor’s Strategy on the Market

As Saylor’s company continues to make headlines, analysts are closely monitoring its moves. Some experts express concern that this aggressive buying could lead to market imbalances. The potential for artificial scarcity due to institutional accumulation raises questions about the future price trajectory of bitcoin.

Scrutinizing the All-bitcoin Model

Despite the impressive performance of Saylor’s firm, the sustainability of its business model has sparked significant debate. A recent report from a venture capital firm cautions against the proliferation of companies attempting to replicate Saylor’s strategy. Many of these firms are less capitalized and rely on debt or equity issuance to finance their bitcoin purchases, creating a precarious leverage situation.

The report warns that in the event of a market downturn, only a select few of these companies may survive.

“When bankruptcies inevitably strike, the strongest players will buy out struggling companies, and the sector will consolidate.”

In such a scenario, Saylor’s firm could emerge even stronger, further solidifying its dominance in the bitcoin market. What distinguishes Saylor’s company from its competitors is its substantial bitcoin holdings, extensive experience, and resilience during previous market downturns. Throughout the 2022 “crypto winter,” the firm maintained its strategy without succumbing to panic, demonstrating a level of discipline that few can match.

Conclusion: A Bold Vision for the Future

Michael Saylor epitomizes the audacity of a new wave of crypto capitalism. He is betting on a future where bitcoin becomes increasingly integral to the global economy. Whether this strategy will be viewed as visionary or overly ambitious remains to be seen, but one thing is clear: Saylor’s commitment to bitcoin acquisition is unwavering.