Solana Surges: DeFi Accumulates 999,999 SOL Tokens on Balance Sheet

Solana (SOL) Price Surge Following Major Acquisition by DeFi Development Corporation

DeFi Development Corporation’s Bold Move in Cryptocurrency

The value of Solana (SOL-USD) experienced a significant increase on Monday after a Florida-based real estate data firm revealed its acquisition of nearly one million units of the cryptocurrency. This development highlights a growing trend among companies to integrate digital assets into their financial strategies.

Major Acquisition Details

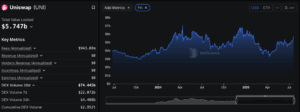

DeFi Development Corporation (DFDV), which is publicly traded on Nasdaq and located in Boca Raton, Florida, announced that it now possesses 999,999 SOL tokens, which are essential for operating the Solana blockchain. Between July 14 and July 20, the company purchased 141,383 SOL tokens, investing approximately $19 million at an average price of $133.53 per token.

Financial Maneuvers and Stock Performance

In addition to its cryptocurrency acquisition, DeFi Development Corporation reported raising around $19.2 million through an equity line of credit by issuing 740,000 shares of common stock, as stated in a press release on Monday. Despite this strategic move, the company’s stock saw a decline of over 3% by the end of the trading day, although it remains significantly higher—34 times its opening price of 67 cents at the start of the year.

The Rise of Crypto Treasury Strategies

DFDV is part of a larger movement, with over 150 publicly traded companies adopting a “crypto treasury” approach. This strategy involves leveraging a combination of debt and equity to acquire substantial amounts of cryptocurrency. The concept gained traction following Michal Saylor’s pioneering efforts with MicroStrategy, which began in 2020 when he transformed the business intelligence firm into a major player in Bitcoin acquisition.

Other Companies Joining the Trend

Several companies are following this model, including GameStop (GME) and Trump Media (DJT), the latter of which recently announced a $2 billion Bitcoin purchase. Additionally, firms like BitMine Immersion Technologies (BMNR), led by Tom Lee of Fundstrat, are focusing on acquiring Ethereum (ETH-USD), the second-largest cryptocurrency by market capitalization.

Market Reactions and Skepticism

While many of these ventures have resulted in substantial stock price increases that often surpass the actual market value of the cryptocurrencies held, there are skeptics. Short sellers express concerns about the sustainability of this trend, questioning how long such dynamics can endure.

Supply Dynamics of Solana

Unlike Bitcoin, which has a capped supply of 21 million coins, Solana does not have a maximum limit on its total supply, adding another layer of complexity to its valuation and market behavior.

David Hollerith is a senior reporter for Yahoo Finance, focusing on banking, cryptocurrency, and various financial topics. For further insights, you can reach him at [email protected].

For comprehensive analysis on the latest stock market developments and their impact on stock prices, click here.

Stay updated with the latest financial and business news from Yahoo Finance.