Texas Plans $10M Bitcoin Purchase: A Bold Move in Crypto Investment

Texas Becomes First State to Establish Public bitcoin Reserve

Texas Takes a Bold Step in Digital Finance

In a groundbreaking move, Texas has emerged as the first state in the United States to set up a publicly funded bitcoin reserve. This initiative was made possible after Governor Greg Abbott approved Senate Bill 21 over the weekend, paving the way for an independent bitcoin reserve that will operate separately from the state’s main treasury. This action aligns Texas with a select group of states that are beginning to explore the potential of digital asset reserves.

Funding the Future of Finance

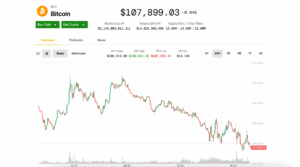

Unlike other states such as Arizona and New Hampshire, which have merely authorized similar reserves, Texas is taking a proactive approach by allocating funds for its bitcoin reserve. The state plans to invest $10 million to acquire bitcoin, a move that, while representing only a fraction of the overall state budget, could significantly influence perceptions among investors and entrepreneurs. Lee Bratcher, the president of the Texas Blockchain Council, emphasized that this investment signals Texas’s recognition of the digital finance landscape.

National Context and Legislative Support

This development follows the announcement from the Trump administration regarding a national cryptocurrency reserve, which is expected to be funded through budget-neutral methods, including asset seizures or the issuance of crypto bonds. In addition to Senate Bill 21, Governor Abbott also signed HB 4488, a complementary bill designed to safeguard the bitcoin reserve from being redirected into the state’s general revenue during routine financial adjustments.

A New Perspective on Digital Assets

The passage of this legislation signifies a notable shift in how states may begin to view digital assets. Rather than merely treating them as speculative investments, Texas is positioning these assets as legitimate financial instruments worthy of long-term consideration. This approach could set a precedent for other states as they navigate the evolving landscape of digital finance.