Thumzup, Backed by Donald Trump Jr., to Acquire Ether, XRP, Solana

Thumzup Media Expands Crypto Holdings with Trump Jr.’s Backing

Key Developments in Thumzup’s Crypto Strategy

Thumzup Media, a Los Angeles-based firm specializing in social media marketing and cryptocurrency investments, has announced a significant expansion of its digital asset portfolio. The company’s Board of Directors has given the green light to diversify its holdings beyond bitcoin, which currently exceeds $2 million in value.

New Altcoin Acquisitions Planned

The company plans to acquire a range of altcoins, including Ether (ETH), Ripple (XRP), Solana (SOL), Dogecoin (DOGE), Litecoin (LTC), and USD Coin (USDC). This strategic move aims to enhance Thumzup’s position in the rapidly evolving cryptocurrency market.

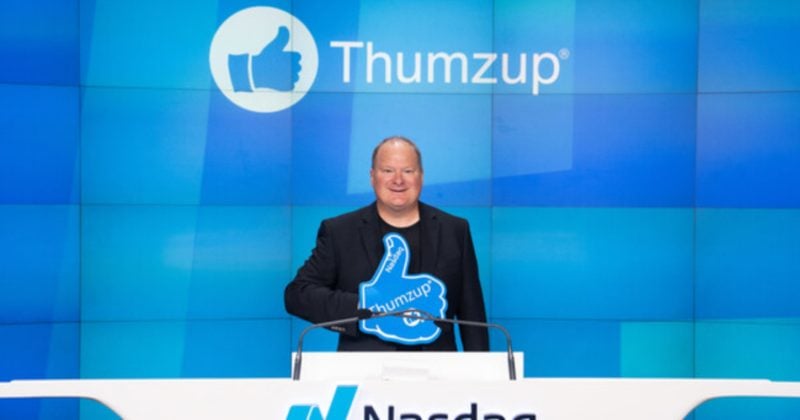

Trump Jr.’s Investment in Thumzup Media

In a noteworthy development, Donald Trump Jr. has purchased 350,000 shares of Thumzup Media, a stake valued at over $4 million. This investment was made based on the advice of his financial advisor, although Trump Jr. does not hold an active role within the company.

Broader Trend Among Trump Affiliates

This investment aligns with a growing trend among entities associated with Donald Trump, as they increasingly adopt cryptocurrency treasury strategies. For instance, Trump Media, the parent company of Truth Social, has announced plans to allocate $2.3 billion towards bitcoin investments, while Dominari is actively pursuing bitcoin ETFs.

Financial Performance and Market Reactions

Despite the high-profile investment, Thumzup Media reported a substantial loss of over $2 million against a mere $151 in revenue during the first quarter of 2025. Following this news, shares of the company experienced a nearly 14% decline in intraday trading, as reported by Yahoo Finance.

Conclusion

Thumzup Media’s strategic expansion into altcoins, backed by Donald Trump Jr.’s investment, marks a significant shift in its approach to digital assets. As the company navigates its financial challenges, its commitment to diversifying its cryptocurrency holdings may play a crucial role in its future growth and stability.