US Explores Crypto Assets for Mortgage Payments: A Financial Revolution

Federal Agencies Explore Inclusion of Digital Assets in Mortgage Risk Assessments

Potential Impact on Mortgage Lending Practices

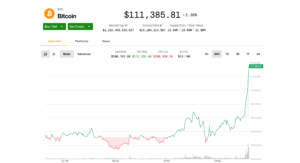

In late June, U.S. federal authorities instructed Fannie Mae and Freddie Mac to investigate the possibility of incorporating digital assets from regulated exchanges into mortgage risk evaluations. This initiative aims to assess whether cryptocurrencies and similar assets could play a role in determining a borrower’s financial stability and ability to repay loans.

Implications for the Cryptocurrency Sector

Bloomberg’s Isabelle Lee joined hosts Sonali Basak and Tim Stenovec on ‘Bloomberg Crypto’ to analyze how this development might influence both the cryptocurrency market and the housing sector. The discussion highlighted the potential for digital currencies to reshape traditional lending criteria, which could lead to significant changes in how lenders evaluate borrowers.

The Future of Housing and Digital Assets

As the landscape of finance evolves, the integration of digital assets into mortgage assessments could pave the way for new opportunities and challenges in the housing market. Stakeholders are keenly observing how these changes might affect lending practices and the broader implications for the economy.

This exploration into the intersection of digital currencies and mortgage lending underscores a growing recognition of the importance of digital assets in contemporary financial assessments.