Wall Street Showdown: Investment Titan Challenges $100B Rival Firm

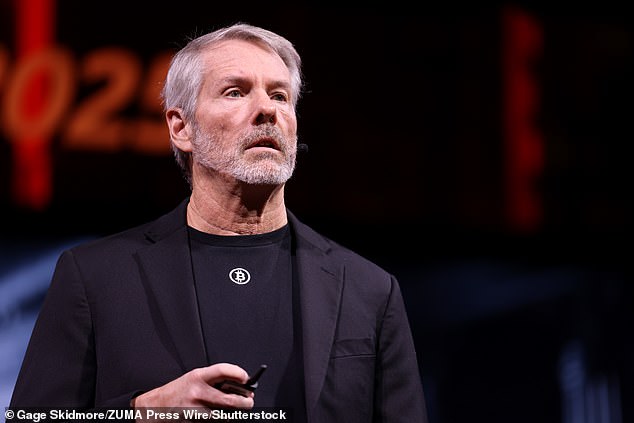

Billionaire Showdown: Michael Saylor vs. James Chanos in the bitcoin Arena

A High-Stakes Clash Over bitcoin‘s Future

Two prominent figures in the financial world, Michael Saylor and James Chanos, are engaged in a fierce battle that could significantly influence the trajectory of bitcoin. This ongoing rivalry has reverberated through the stock market, capturing the attention of investors and analysts alike.

Saylor’s bitcoin Empire

Michael Saylor, the executive chairman of MicroStrategy, has amassed an impressive collection of over 500,000 Bitcoins, which he refers to as his ‘treasury.’ Over the past five years, Saylor has strategically acquired this digital currency, leading to a remarkable increase in his wealth, which now exceeds $8 billion since the election of Donald Trump.

MicroStrategy’s stock has skyrocketed by an astonishing 1,500% since 2020, with the value of Saylor’s bitcoin holdings currently estimated at nearly double that of bitcoin itself. As MicroStrategy prepares to potentially join the S&P 500, the implications for investors could be profound, affecting numerous 401(k) plans across the nation.

Chanos Takes a Stand

On the other side of the ring, James Chanos, a well-known Wall Street figure famous for short-selling, has publicly criticized Saylor’s investment strategy. He has labeled Saylor’s approach as ‘financial gibberish’ and has warned that Saylor’s high-stakes gamble could lead to significant losses for investors if the market turns against him.

Chanos made headlines at the Sohn Investment Conference in May when he announced his decision to sell MicroStrategy stock while simultaneously investing in bitcoin. He argues that Saylor’s bitcoin ‘treasury’ is grossly overvalued, comparing his strategy to purchasing an asset for $1 and selling it for $2.50.

The Market’s Reaction

The ongoing feud has captivated Wall Street traders, with many viewing it as a critical test of the cryptocurrency sector’s resilience. Financial analyst Jim Osman remarked that this confrontation resembles a high-stakes poker game, where one party is betting on bitcoin‘s future while the other is betting against it. Osman posed a fundamental question: “Do you want to bet on a dream, or do you want to bet against it?”

Saylor’s bitcoin holdings are currently valued at approximately $59 billion, and he is so passionate about the cryptocurrency that he has even shared AI-generated images of himself as various action heroes, including ‘bitcoin Superman.’

Chanos’s Skepticism

Chanos has long been critical of cryptocurrencies, previously describing them as a ‘libertarian fantasy.’ He has expressed concerns about bitcoin‘s stability, citing its lack of backing by any major currency and its association with illicit activities. With a net worth of around $2 billion, Chanos has built his reputation on shorting companies, most notably betting against Enron before its infamous accounting scandal in 2001.

When Chanos initiated his short position against Saylor’s company, he warned that MicroStrategy’s approach could encourage other less stable firms to follow suit, potentially leading to widespread financial losses.

Escalating Tensions

The rivalry intensified earlier this month when Saylor criticized Chanos on Bloomberg TV, cautioning that if MicroStrategy’s stock continues to rise, Chanos could face significant financial repercussions. Chanos responded by dismissing Saylor’s claims, asserting that he views Saylor as a skilled salesman rather than a credible financial strategist.

Interestingly, Donald Trump, who once expressed skepticism about cryptocurrencies, has since embraced the concept, even launching his own cryptocurrency, $TRUMP coin, earlier this year. In a move reminiscent of Saylor’s tactics, Trump Media & Technology Group recently announced plans to raise $2.5 billion to establish its own bitcoin treasury.

As this high-stakes battle unfolds, the financial world watches closely, eager to see who will emerge victorious in this clash of titans.