Will Ethereum Skyrocket to $5K? Expert Insights on a Potential Surge!

ethereum Poised for a Major Breakout: Is the $5,000 Target Within Reach?

The Current Landscape: ethereum‘s Technical Indicators

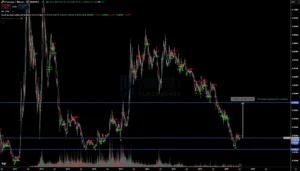

ethereum is currently exhibiting significant upward momentum. Recently, it surpassed critical price levels of $3,200 and $3,350, marking its highest point since February. Analysts are interpreting these breakouts as early signs of a potentially larger upward movement.

One analyst employing the Wyckoff reaccumulation model believes ethereum has successfully navigated its testing phase and is now set for a substantial rally. Another analyst, using Elliott Wave theory, forecasts a trajectory that could see ethereum reach $9,400, with the $5,000 mark serving as a crucial psychological milestone along the way.

Institutional Interest on the Rise

ethereum‘s recent gains are not merely driven by retail enthusiasm; they are also attracting significant institutional investments. In the last two months, over 570,000 ETH have been acquired by publicly traded companies. Notable firms like SharpLink Gaming, BitMine, and BTCS have collectively raised upwards of $1 billion to establish ethereum reserves.

SharpLink has emerged as the largest publicly traded holder of ethereum, having invested $225 million in ETH. This trend indicates a growing institutional interest in the cryptocurrency.

Regulatory Developments Favoring ethereum

The timing of this surge can be attributed to two key factors: regulatory clarity and the recent passage of the GENIUS stablecoin bill in the U.S. Senate, which is viewed as beneficial for ethereum‘s ecosystem. Coupled with the inflow of $3.27 billion into ETH ETFs since May, it’s evident that ethereum is gaining traction as a serious asset among corporate treasuries.

Potential for an Altcoin Rally

ethereum‘s strength may signal the onset of a broader altcoin rally. Bitcoin’s dominance is nearing 70%, a threshold that historically indicates the peak of Bitcoin’s performance. Once this dominance begins to decline, capital typically shifts toward altcoins, often starting with ethereum as the leading altcoin.

Currently, the Altcoin Season Index remains low, suggesting that now may be an opportune time to accumulate altcoins before the market heats up. As ethereum gains momentum, it could catalyze a wider market rally, especially with Bitcoin dominance just 5.5% shy of its 2021 peak.

On-Chain Metrics and Smart Money Trends

What bolsters ethereum‘s current rally is the robust underlying strength. Since July began, open interest in ETH derivatives has increased by 1.84 million ETH, indicating a solid rise without the excessive leverage seen in previous cycles. Funding rates remain modest, reflecting disciplined market positioning.

On the on-chain front, ethereum appears equally strong. Following the Pectra upgrade, which enhanced the staking mechanism, more ETH has been locked into staking pools. Since June 1, an additional 1.51 million ETH has been staked, with a significant portion likely coming from treasury firms establishing long-term positions.

Is $5,000 a Realistic Target for ethereum?

While ethereum has yet to reach the $5,000 mark, it faces resistance around $3,470 that it must overcome for a serious push toward that target. However, the current conditions make this goal seem increasingly attainable.

The technical indicators are aligning favorably. Institutions are actively purchasing ETH, derivatives data appears healthy, and the broader market is poised for a shift. If ethereum continues its upward trajectory and gains momentum, the much-anticipated “God candle” could soon illuminate the charts.

Technical Outlook: Will ethereum Experience a Breakout?

While predicting the future in crypto is inherently uncertain, the current indicators suggest a potential breakout is on the horizon. With bullish technical signals, institutional inflows, solid derivatives data, and a market that seems to be holding its breath, the conditions are ripe for a significant move.

If ethereum can clear the $3,700 resistance and make strides toward $4,000, the dream of a $5,000 God candle may soon become a reality. Conversely, should the market experience a downturn, key support levels are identified at $2,945, $2,505, and $2,400.

Disclaimer: The information provided in this article is for educational purposes only and should not be considered financial or investment advice. Always conduct your own research before making trading decisions. The accuracy of this information is based on the date of publication, and circumstances may change, affecting its validity. Past performance is not indicative of future results.