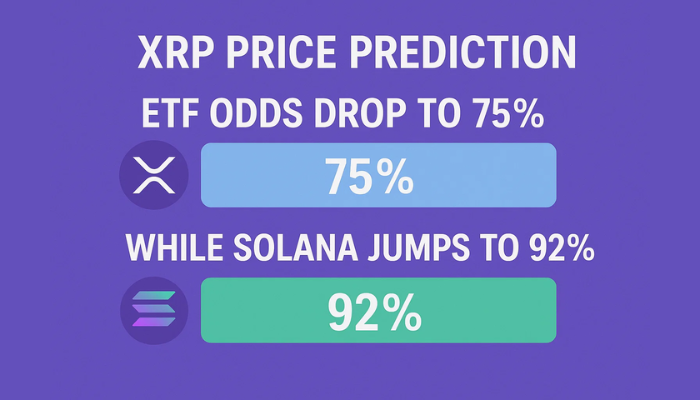

XRP ETF Odds Fall to 75% as Solana Soars to 92% Approval Rate

XRP ETF Approval Odds Decline Amid Legal Uncertainties

Overview of XRP ETF Odds

Recent developments have seen the likelihood of XRP’s ETF approval decrease significantly, dropping from 98.2% to 75% over a two-week period, before slightly rebounding to 78%. This marks the first instance since April where the odds have dipped below 80%, raising concerns regarding the ongoing regulatory landscape.

Legal Challenges Impacting XRP

The primary factor contributing to this decline is the persistent legal ambiguity surrounding Ripple’s ongoing case with the SEC. Although Ripple has withdrawn its appeal in this high-profile matter, the case remains unresolved. Former SEC attorney Marc Fagel noted that the case is still active unless the SEC formally retracts its appeal through a vote, which is currently affecting institutional confidence.

Key Points on XRP’s ETF Odds

- Significant Drop: XRP’s ETF approval odds have decreased by 23 percentage points in just two weeks.

- Ongoing Legal Battle: Ripple’s legal issues with the SEC are still unresolved.

- Analyst Predictions: Despite the decline, Bloomberg analysts maintain a 95% probability of eventual approval.

Some experts view this downturn as a temporary response to procedural delays rather than a fundamental shift in market dynamics. A favorable resolution could quickly restore investor confidence.

Solana’s ETF Approval Odds Surge

In contrast to XRP’s struggles, Solana has seen its ETF approval odds soar to 92%, the highest among all cryptocurrencies. This surge is attributed to clearer legal conditions, robust network performance, and strong institutional interest.

Factors Driving Solana’s Success

- No Legal Threats: Solana is currently free from active lawsuits or regulatory challenges.

- Efficient Transactions: The blockchain offers faster and more cost-effective transactions.

- Attractive Staking Options: ETFs tied to Solana provide an annualized yield of 8%.

Additionally, an upcoming hard fork aimed at enhancing efficiency is expected to further bolster Solana’s position in the ETF race.

Technical Analysis of XRP

Despite the regulatory challenges, XRP’s technical indicators suggest a bullish outlook. Currently priced at $2.19, XRP is testing the $2.20 resistance level, forming an ascending triangle pattern on the hourly chart, which often precedes upward breakouts. A golden cross at $2.14, where the 50-day moving average crosses above the 200-day moving average, supports this bullish sentiment.

Trading Strategy for XRP

- Entry Point: Consider buying if XRP breaks above $2.205.

- Target Prices: Aim for initial targets of $2.232 and $2.277.

- Stop-Loss: Set a stop-loss below $2.166 to manage risk.

Market participants will be closely monitoring for a volume-supported move above $2.20 to confirm the breakout. If momentum stalls, a retest of $2.13 may occur.

Conclusion

In summary, XRP’s ETF approval odds are currently weak at 75% due to ongoing legal challenges, while Solana leads with a strong 92% likelihood of approval backed by institutional support. Technically, XRP shows potential for a bullish breakout if it surpasses the $2.20 resistance level, targeting $2.27 in the near term.